THE LATEST ECONOMIC TRENDS IN CRE | January 2025

- Colliers | Columbus

- Feb 4

- 1 min read

Written by: Collin Fitzgerald

The Ripple Effect of Rising Home Prices on Columbus Commercial Real Estate

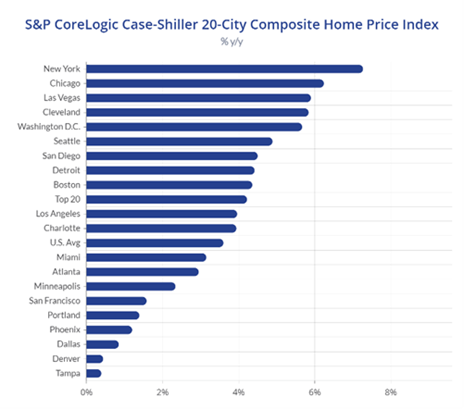

The continued rise in U.S. home prices has direct and indirect implications for the Columbus Commercial Real Estate (CRE) market. While Columbus is not mentioned among the top markets for appreciation, rising residential prices can influence commercial real estate dynamics in several ways. Higher home prices can push more people into renting, increasing demand for multifamily developments and mixed-use projects. Developers and investors in Columbus may find opportunities to expand apartment complexes and rental housing to accommodate residents priced out of homeownership.

Additionally, businesses may reassess their location strategies as home prices rise nationally. Cities with relatively affordable housing, like Columbus, could become more attractive for companies looking to relocate or expand operations while keeping labor costs manageable. This could increase demand for office and industrial spaces, benefiting Columbus' CRE market. However, if housing affordability continues to erode, it could slow in-migration and dampen the demand for new retail and commercial developments.

Source: S&P, MSN

Our Take

The sustained growth in home prices signals strong economic fundamentals but raises concerns about affordability and its impact on commercial real estate in Columbus. Multifamily and rental property investments will likely remain attractive as more individuals opt for renting over buying. At the same time, Columbus’ relative affordability compared to high-growth markets like New York or Seattle could position it as an emerging destination for businesses seeking cost-effective expansion. Investors should monitor housing trends closely, as shifts in affordability and migration patterns will play a crucial role in shaping future CRE demand.

Comments